This time each year, I look forward to my “World Tour” in APAC and EMEA, spending time with G2 employees, customers, partners, and other SaaS leaders and entrepreneurs.

Reflecting on the conversations had at our G2 Live and Midyear Meetup events in Bangalore, as well as SaaStock in Dublin, I continue to be bullish on the growth of software globally and the role AI will play in accelerating that growth.

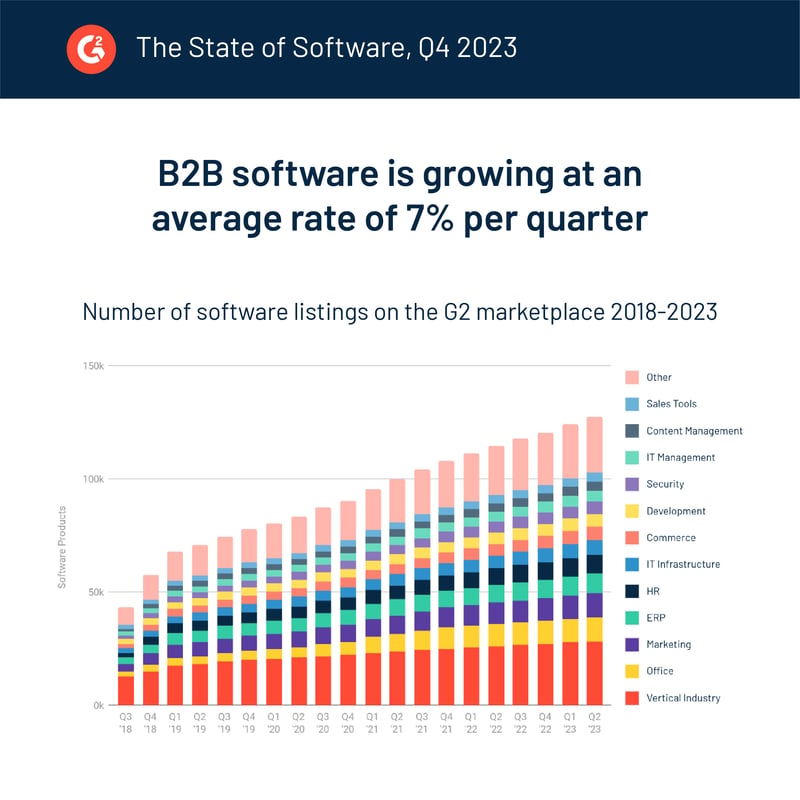

The B2B software landscape continues to grow, with leaders being built globally

Despite the economic environment, software continues to be an opportunity for growth globally. Over the past five years, software listings on G2’s marketplace have grown at a rate of 7%.

This positive trend represents a global opportunity. While 74% of G2 Leaders are based in the Americas, 17% derive from countries in EMEA, while 9% come from the APAC region. As buyers are becoming region-agnostic, they are looking for best-of-breed software built by entrepreneurs anywhere in the world.

While venture funding and dealmaking have slowed across the board, we see positive indicators in the regions I visited. So far this year, $7.6 billion has been invested across 977 deals in India – with total deal value increasing over the last two consecutive quarters. Additionally, Indian SaaS centaurs and unicorns have been forecast to bring in more than $20 billion in revenue by 2023.

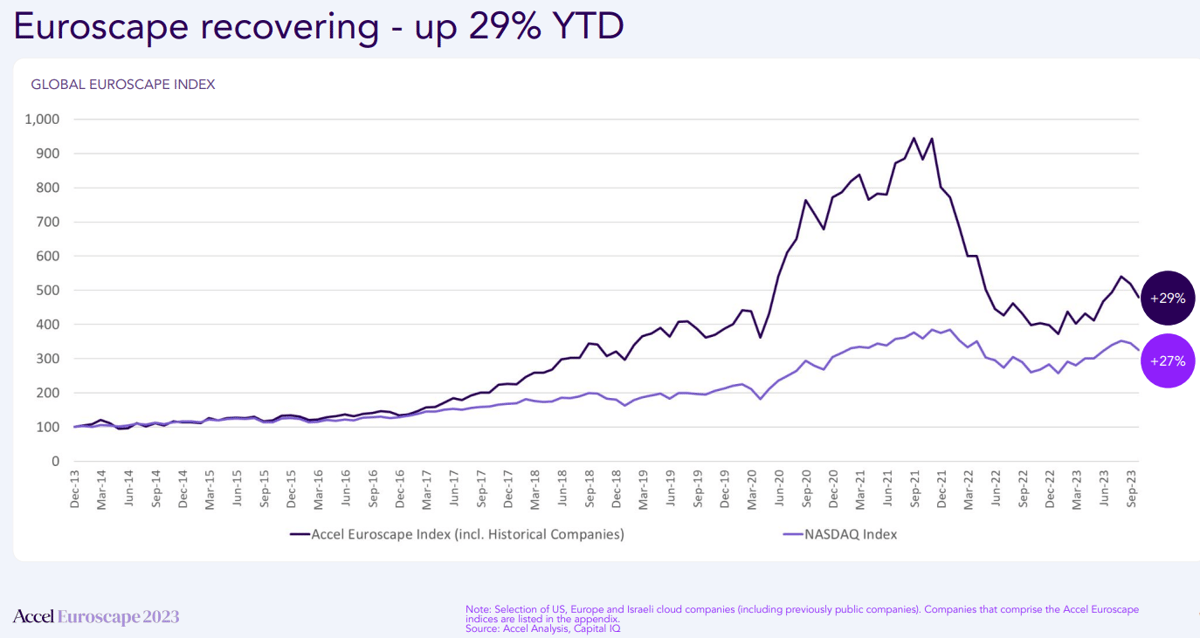

We see bright spots in EMEA too. The newly released 2023 Accel Euroscape reports that: “With $31 billion invested in private cloud companies year to date, we have converged to pre-covid levels in Europe and Israel ($11B 2023 YTD), and the U.S. ($20B 2023 YTD).

However, it has been remarkable to see that the European and Israeli cloud ecosystems have solidified their relative strengths and represent more than half of the US (53%), which is greater than the 46% observed in 2020.” Year to date, the Euroscape is up 29%.

All indicators point to a recovery on the horizon and a ripe growth opportunity for SaaS innovators globally.

AI is driving software growth today, accelerating innovation & digital buying

It’s no coincidence that this growth opportunity coincides with the rise of AI. We’ve already observed the shift of B2B software buying to mirror consumer-like shopping. In fact, 67% of global B2B software buyers say they usually engage a salesperson at a software company only when they have made a purchasing decision. Now, as we’ve entered an age of AI, we’re seeing an acceleration in software innovation and the shift to digital buying.

OpenAI’s ChatGPT has ushered in the most exciting era in software since the launch of the visual internet and iPhone. At G2, we’ve leaned into this trend with Monty – the first-ever software buying assistant, designed to make the process of finding the best software for a buyer’s unique business needs faster and easier than ever.

We’re also seeing SaaS vendors race to launch new AI software solutions, with 643 new products added to AI categories over the past year on G2 – making AI the fastest-growing software market (+39% YoY). Accel reports that while the majority of generative funding has gone to U.S. companies, there are many promising generative AI companies emerging in Europe and Israel, which have raised $7.6 billion collectively.

Software buyer behavior is changing rapidly too, as AI capabilities are expected. According to G2’s 2023 Software Buyer Behavior Report, 81% of global buyers say it is important that the software they purchase moving forward has AI functionality, and 78% trust the accuracy and reliability of AI-powered solutions.

India in particular is leading the world in AI adoption in trust. Indian respondents ranked highest (78%) in a global survey asking respondents if they currently use AI at work. This trust, I believe, stems from APAC SaaS entrepreneurs who are leading AI innovation thanks to the tremendous data science and AI talent in the region.

AI is the ultimate growth wave for SaaS innovators

A year ago I suggested SaaS companies win by riding big waves. AI has solidified itself as the ultimate growth wave, radically changing the way we buy and sell software.

Despite global economic tough times and funding slowdown, the SaaS landscape across APAC, EMEA, and the Americas is resilient. By shifting to smart organic growth, continuing to innovate with AI, and adapting to evolving buying behaviors, SaaS innovators will accelerate growth in the years ahead.