JasonDoiy

Alphabet stock (NASDAQ:GOOG) (NASDAQ:GOOGL) surged 6% early Wednesday to tag a 15-month high, riding off modest but steady growth in a giant advertising-based business as it posted second-quarter results that beat Wall Street expectations.

Google advertising revenues rose 3.3% to just over $58B for the quarter, despite a slight decline in the Google Network segment. That’s thanks to Google’s Search advertising business — the company’s core and dominant source of its sales, which grew by 4.8% to $42.6B. That total made up 73% of all of Google’s ad revenues.

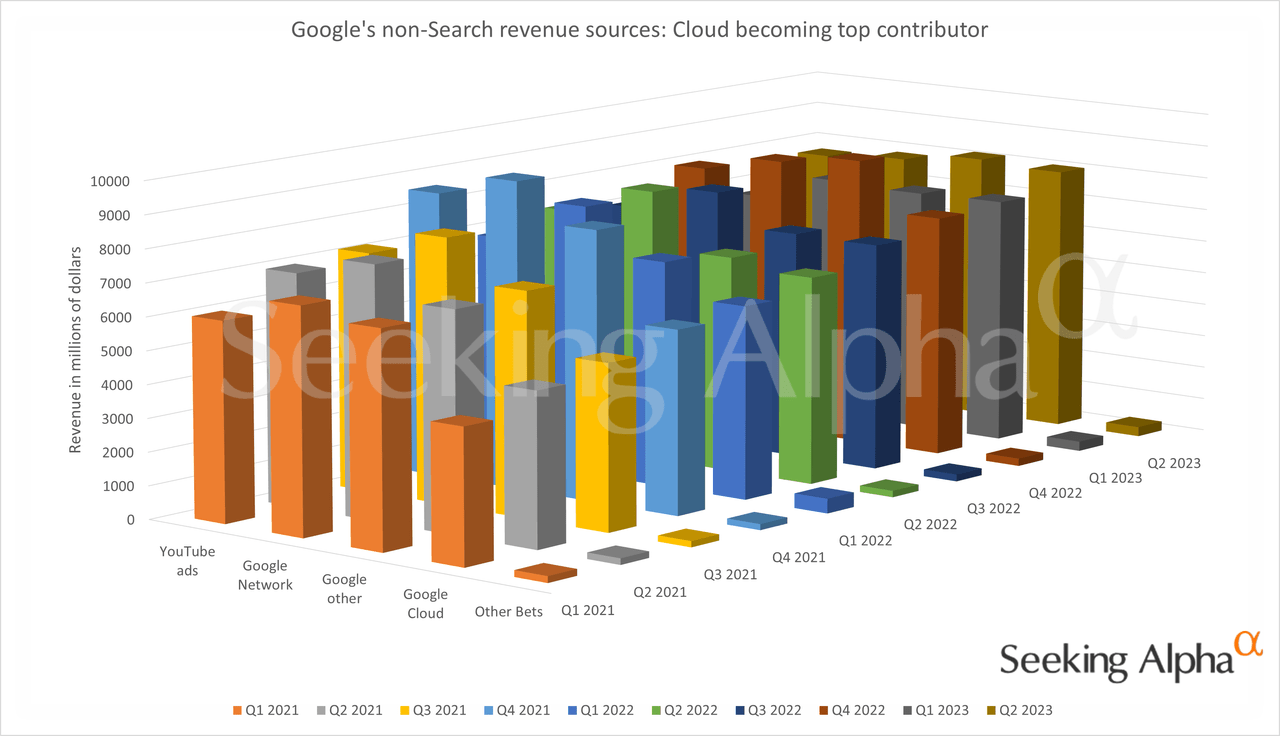

Where Alphabet departs from an ad-centric Internet rival like Meta Platforms (META), though, is in the notably heavier contributions made from its other revenue streams, including not only YouTube ads but also premium subscriptions and significantly a solidly growing Cloud computing business.

Extract Google Search revenue from Alphabet’s totals, as the chart above does, and the steady and heavy growth of Google Cloud becomes more apparent: Cloud revenues nearly doubled in just over two years, from $4.05B in the first quarter of 2021, and this quarter it nearly became the top non-Search contributor to revenue. If not for Q2’s strong sequential quarterly growth in Google Other revenues (to $8.14B), Cloud would already be the company’s No. 2 revenue contributor.

It’s still playing catch-up to Microsoft’s (MSFT) Intelligent Cloud unit and Azure, which contributed $24B to the Microsoft top line this quarter, but it’s exhibiting similar growth, as the Cloud pie keeps expanding.

Back on Google Cloud, notably, revenue growth appeared to stabilize despite some optimization, BofA’s Justin Post pointed out, prompting Alphabet CEO Sundar Pichai on Alphabet’s earnings call to dig into the relationship of Cloud customer wins and the company’s focus on artificial intelligence.

“Without commenting on the short term, but … when I think about it long term, I view the AI opportunity as expanding our total addressable market and allowing us to win new customers,” Pichai said.

The company has more than 80 models that it can take and translate into deep industry solutions, Pichai said, adding “it gives us an opportunity to upsell and cross-sell into our installed base.” The company can bring its feature to more than 9M paying Google Workspace customers as well as “engage in deeper conversations” with its Cloud installed base.

“More than 70% of Gen AI unicorns are Google Cloud customers,” Pichai boasted, noting the number of cloud AI customers grew more than 15-fold from April to June.

“Among them, Priceline is improving trip planning capabilities. Carrefour is creating full marketing campaigns in a matter of minutes and Capgemini is building hundreds of use cases to streamline time-consuming business processes,” Pichai said. “Our new anti-money-laundering AI helps banks like HSBC identify financial crime risk, and a new AI-powered target and lead identification suite is being applied at Cerevel to help enable drug discovery.”