Michael M. Santiago

The focus on the restaurant sector heats up next week as the Q2 earnings season begins, with McDonald’s (NYSE:MCD) and Domino’s Pizza (DPZ) due to step into the earnings confessional. Restaurant traffic and sales have been resilient this year, although some recent cracks have emerged. The component of the monthly retail sales report that includes restaurant spending showed just a 0.1% month-over-month increase in June after rising 1.2% in May and 0.5% in April.

Cowen analyst Andrew Charles hypothesizes that concepts with strong value perceptions and higher proportional middle income consumer exposure are better positioned to benefit from consumers trading down from fast casual or casual dining. The firm heads into the earnings season with Chipotle (CMG) and Wingstop (WING) singled out as pursuing the right strategic drivers to gain share and mitigate the impact to trade down to cheaper restaurant options.

Stifel thinks McDonald’s (MCD), Chipotle (CMG), and Texas Roadhouse (TXRH) will report domestic comparable sales above the current consensus estimates based on a review of mobile location data. Meanwhile, BTIG analyst Peter Saleh noted checks with franchisees indicated sales momentum and easing pressure on commodities and labor, which are driving improved profitability. UBS took a look at social media engagement trends ahead of the earnings season. The chains that scored high were Jack in the Box (JACK), Pizza Hut (YUM), Texas Roadhouse (TXRH), McDonald’s (MCD), Burger King (QSR), and Papa John’s International. PZZA. The firm anticipates the strong social media growth from the QSRs will correlate with sales momentum going forward.

Outlook: Looking ahead, the Supreme Court’s decision to block the Biden administration’s plan to forgive up to $20,000 of student debt per borrower is seen as potentially disrupting the sector. TD Cowen believes the White House is likely to provide grace periods of 90 days or longer for those who are late in paying, but also warned of a 2% annual headwind to restaurant industry spending as student loan payments resume.

Performance: 45 of the 55 publicly-traded restaurant stocks have seen year-to-date share price gains in 2023. The list of restaurant stocks showing a big YTD rally includes Carrols Restaurant Group (TAST) +301%, Red Robin Gourmet Burgers (RRGB) +169%, Kura Sushi USA (KRUS) +99%, Shake Shack (SHAK) +88%, Potbelly (PBPB) +64%, and Chipotle (CMG) +51%. Red-hot CAVA Group (CAVA) also deserves a callout after doubling in the eight week since its IPO. The YTD restaurant sector laggards include Noodles (NDLS) -37%, Brinker International (DIN) -8%, and Wendy’s (WEN) -5%.

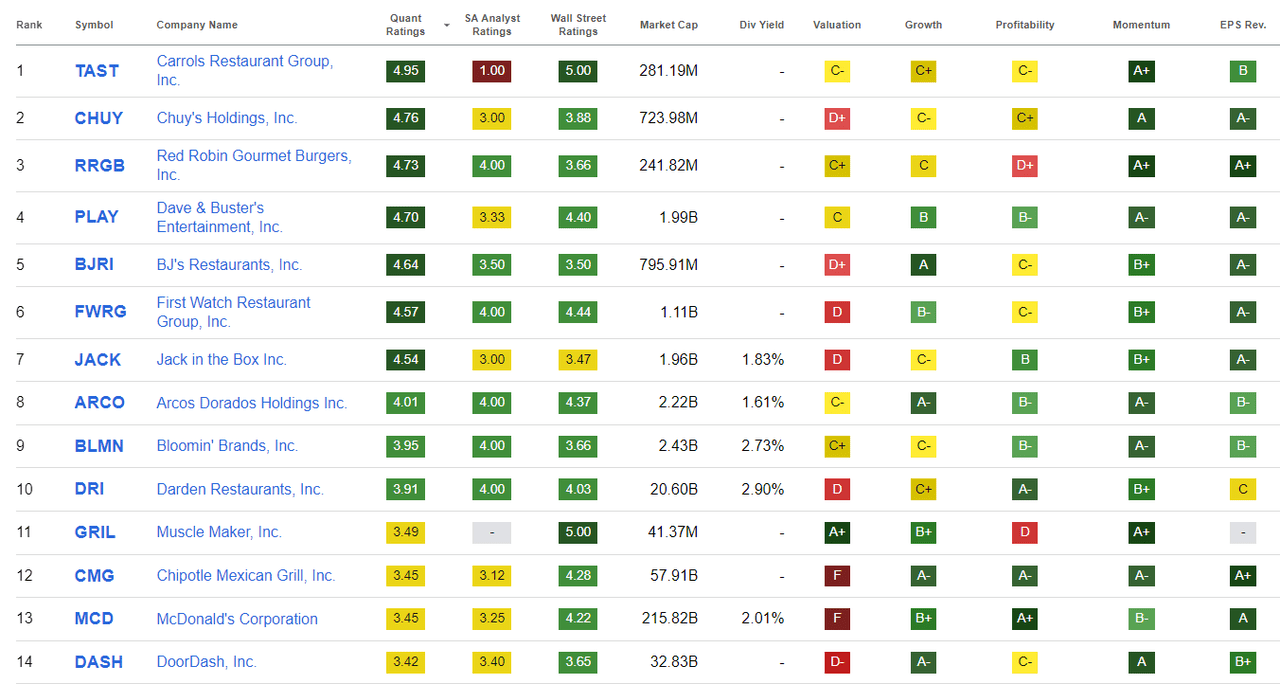

Metrics: The restaurant companies with the strongest sales growth over the last five years are FAT Brands (FAT), The ONE Group Hospitality (STKS), Kura Sushi USA (KRUS), Sweetgreen (SG), and Wingstop (WING). The restaurant stocks with the lowest forward price-to-earnings ratios are Noodles (NDLS), The ONE Group Hospitality (STKS), Brinker International (DIN), Cheesecake Factory, and Bloomin’ Brands (BLMN). The most highly-shorted restaurant names are (KRUS), Red Robin Gourmet Burgers (RRGB), Dutch Bros. (BROS), Cheesecake Factory (CAKE), and Blooming Brands (BLMN). The highest dividend yields in the sector are from FAT Brands (FAT), Cracker Barrel Old Country Store (CBRL), (WEN), Ark Restaurants Corp. (ARKR), and Bloomin’ Brands (BLMN). Adding it all up, the restaurant stocks with the highest Seeking Alpha Quant Ratings are Carrols Restaurant Group (TAST), Chuy’s Holdings (CHUY), Red Robin Gourmet Burgers (RRGB), and BJ’s Restaurants (BJRI).

Restaurant picks from Seeking Alpha analysts include First Watch Restaurant (FWRG) from The Value Pendulum, BJ’s Restaurants (BJRI) from GS Analyics, and The Cheesecake Factory (CAKE) from Welbeck Ash Research.