Federal Reserve officials opted not to raise interest rates in June to assess the impact of previous hikes, and consider what’s next. Meanwhile, unemployment claims fall nationwide.

Homebase data reveals a summer upswing for small businesses, as employment activity grows, wages rise, and employees log more consistent hours.

In economic conditions where forecasts and expectations can change seemingly daily, real-time data on activity across North American businesses shows that warmer weather is bringing shoppers and diners out and about. Homebase seeks to understand how the broader economic environment is affecting small businesses and their employees during the beginning of Q2 by analyzing behavioral data from more than two million employees working at more than one hundred thousand SMBs.

Summary of findings: Main Street job growth sees seasonal boom with outdoor activity in full swing, as longer days translate to more hours for small business employees.

- Employment activity is up on Main Street, but trailing behind historical trends. Employees are working longer shifts to meet demand.

- Employment growth varies across industries. Entertainment saw a massive increase from May to June (22.3%), in-line with prior years. Hospitality saw a jump (8.8%) that lagged previous years’ huge spikes.

- Summer weather is in full effect on small businesses. Northern cities see strong job growth with warm days, while June heatwaves hamper job numbers in the south.

- Wages for hourly workers are on the rise again, driven by service industries, after a dip in May.

Longer summer days lead to longer shifts at SMBs

Small businesses are seeing a big pick-up in activity, though not quite at the same levels as prior years. Owners are relying on existing employees working more to meet demand.

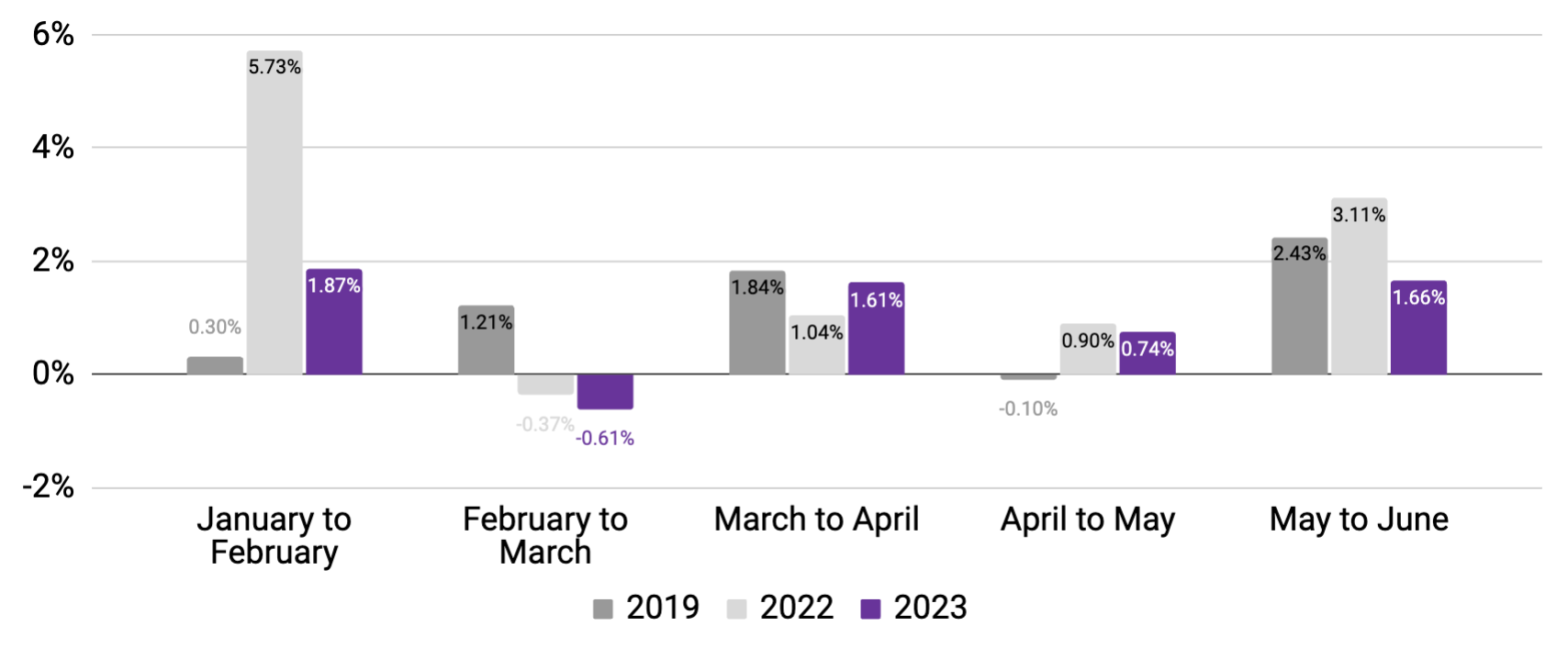

Employees working

(Monthly change in 7-day average, relative to January of reported year)

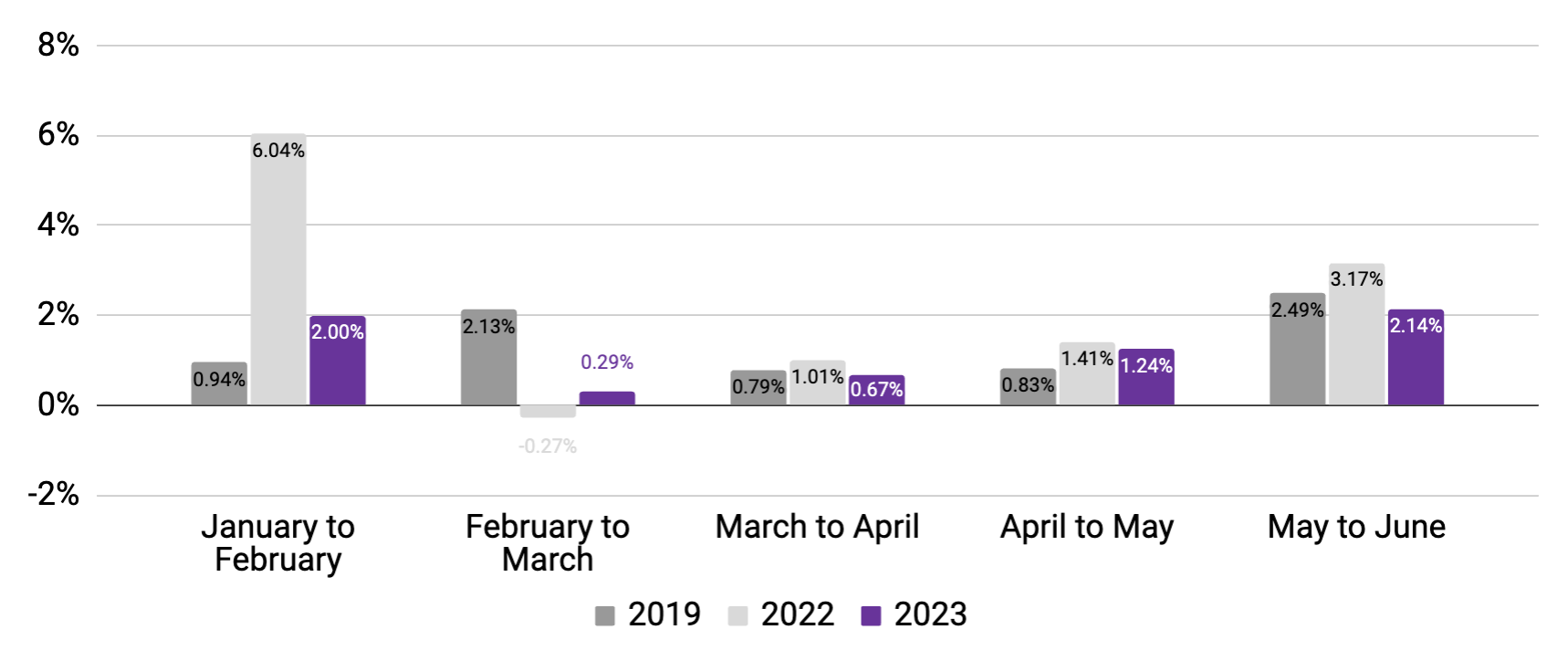

Hours worked

(Monthly change in 7-day average, relative to January of reported year)

Data generally compares rolling 7-day averages for weeks encompassing the 12th of each month; April 2023 data encompasses subsequent week to account for Easter holiday. Source: Homebase data.

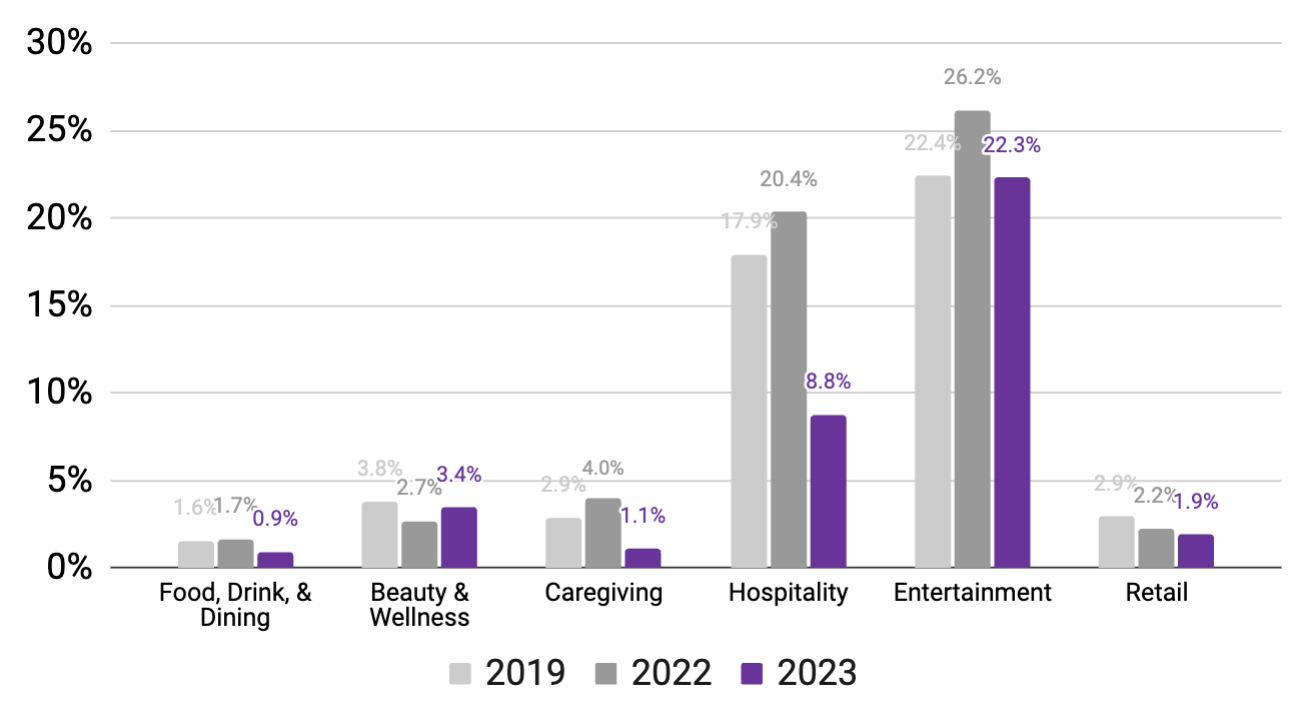

Entertainment is booming for small business

As schools let out, families have been turning to outdoor entertainment to fill their time.As schools let out, families have been turning to outdoor entertainment to fill their time.

Entertainment¹ saw a massive increase from May to June (22.3%), in-line with prior years, while Hospitality saw a jump (8.8%) that lagged previous years’ huge spikes.

Food & dining and retail (0.9% and 1.9%, respectively) also saw increases, but showed more seasonal consistency – Main Street shopping and dining has been a monthly mainstay.

Percent change in employees working

(Mid-June vs. mid-May, using Jan. ‘19 and Jan. ‘23 baselines)²

1. Entertainment includes events/festivals, sports/recreation, parks, movie theaters, and other categories.

2. June 9-15 vs. May 12-18 (2019); June 12-18 vs. May 8-14 (2022); June 11-17 vs. May 7-13 (2023). Source: Homebase data.

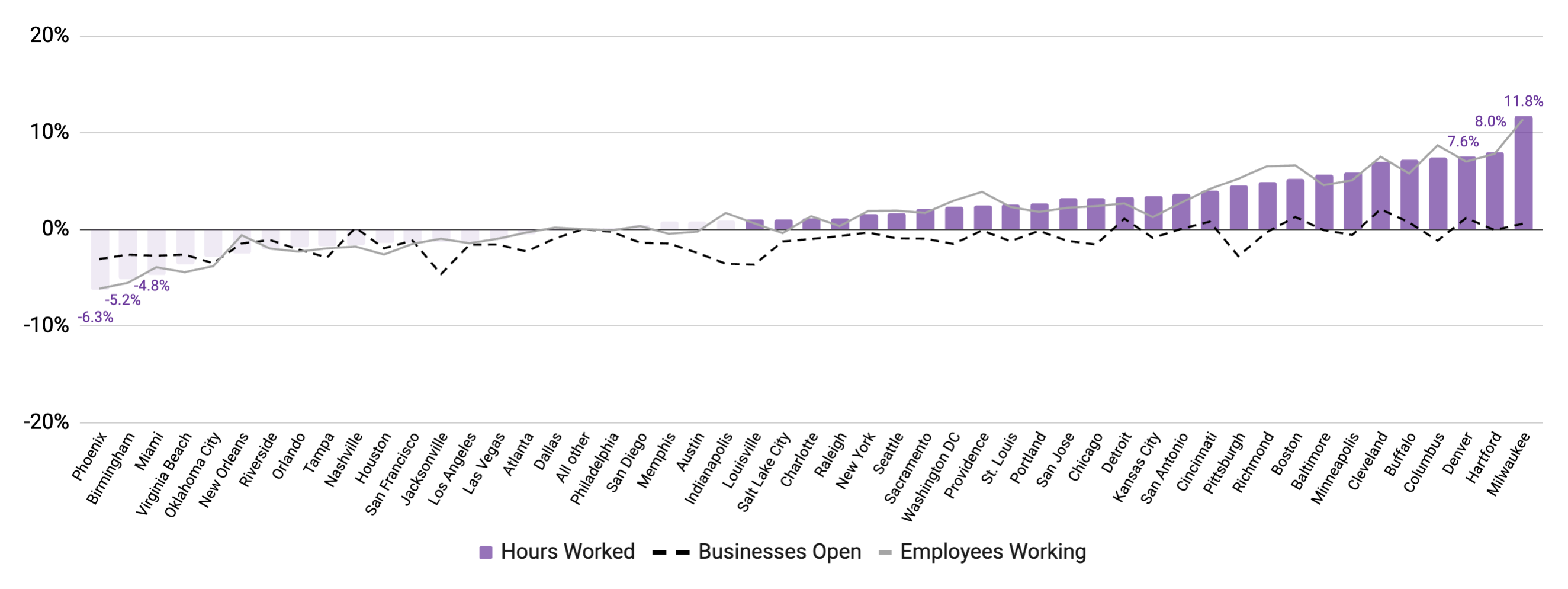

Northern cities saw a weather-driven boost in SMB activity

Unseasonable heat in the south on both coasts led to dampened spending at small businesses.

Note: June 11-17 vs. May 7-13. Source: Homebase data

After a down month, higher wages in service industries pushed earnings up for hourly workers

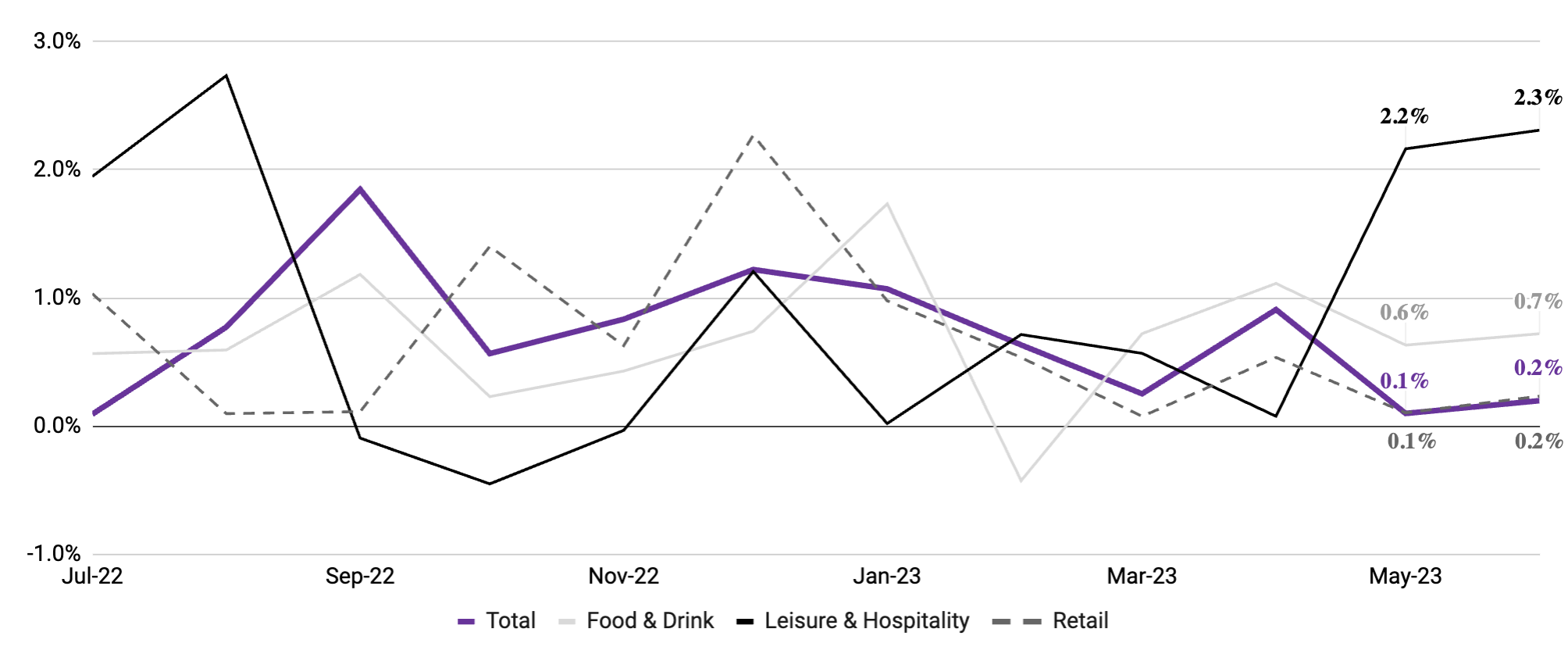

Wage inflation

Month-over-month change in average hourly wages

Note: Data measures average hourly wages for locations that utilized Homebase to pay employees in both June 2022 and June 2023. Source: Homebase Payroll data.

Hourly Employee Pulse Check

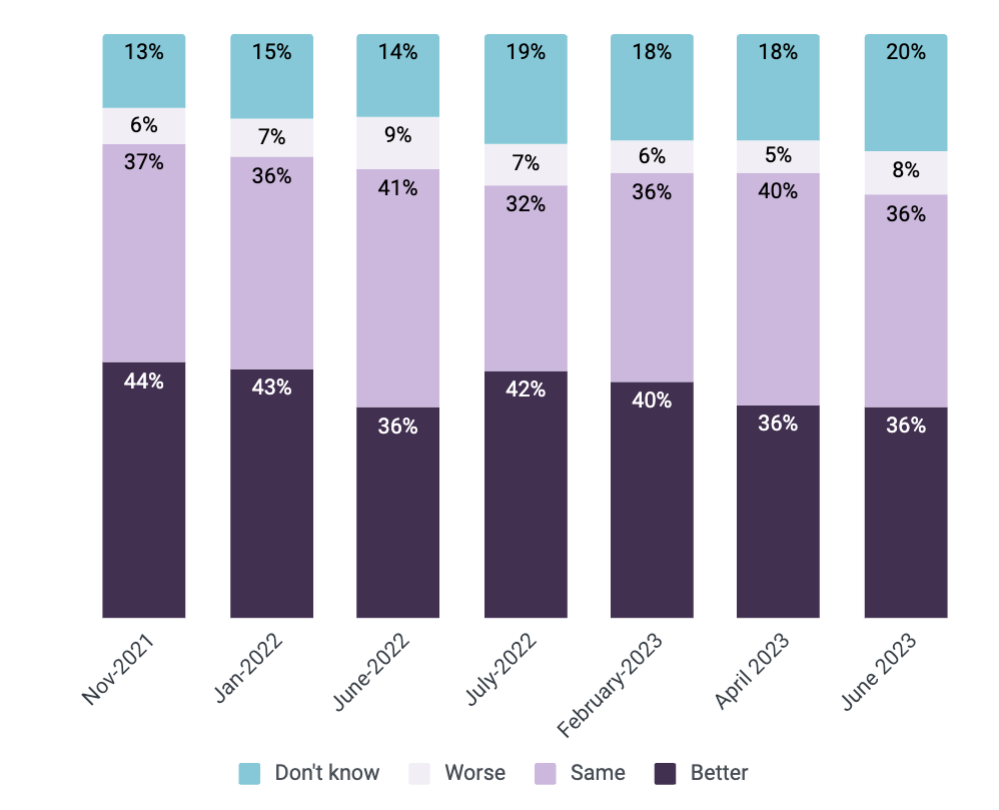

A June pulse check of over six hundred hourly employees shows decreasing optimism towards job prospects.

Longer hours and lower expectations for workers

A majority of employees surveyed still see their job prospects remaining the same or improving (both 36% and 36%, respectively) in a year, though 28% are now either unsure or foresee worse prospects (up from 23% in April). The uptick in respondents reporting pessimism (8%) and uncertainty (20%) shows more and more hourly employees are questioning if the grass really is greener for future prospects.

Small business employees are generally working more this summer than in prior months. While more reliable shifts lessen anxiety about getting enough hours, they also put a damper on optimism for what jobs might be out there next year.

Survey question: Do you think your job options will be better, about the same, or worse in 12 months compared to today?

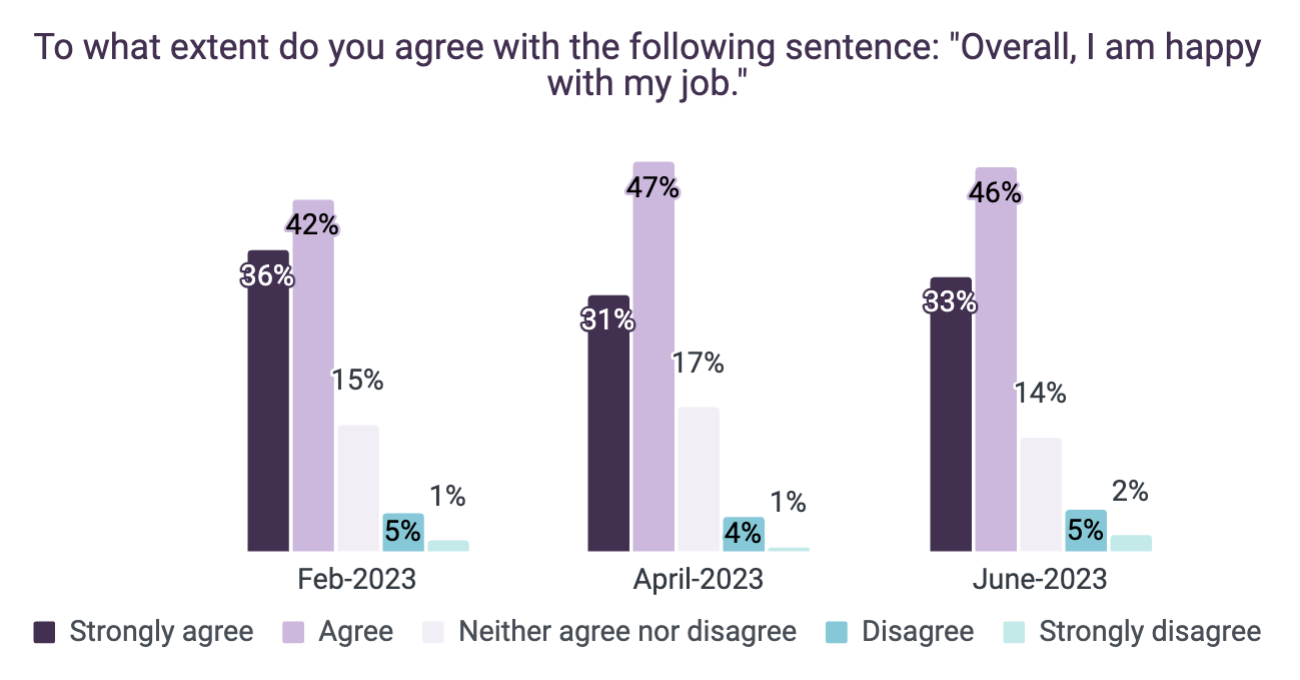

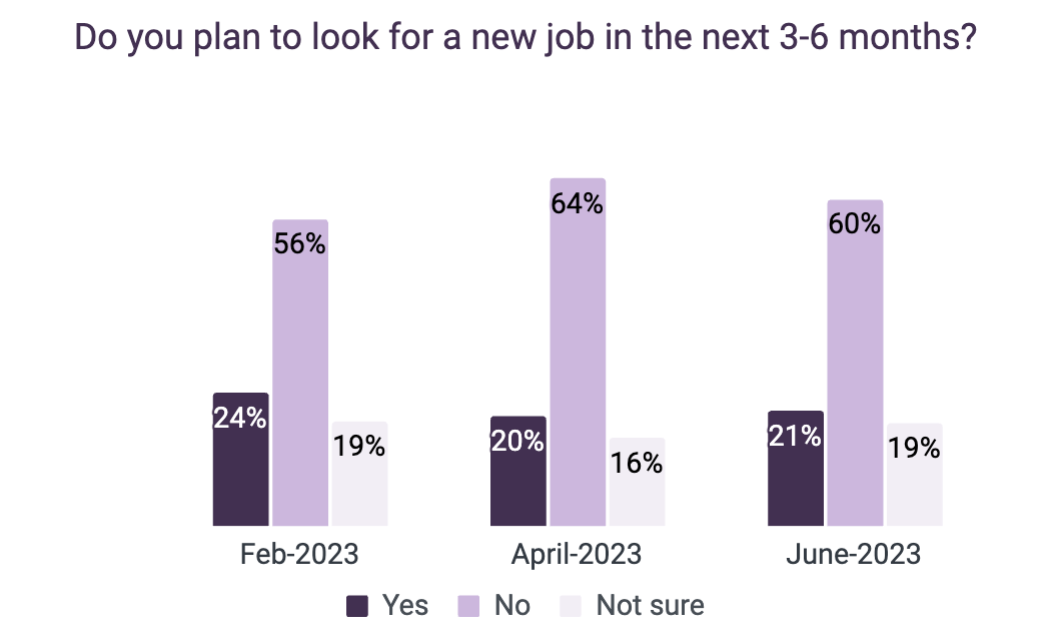

More hours is good news, but not for all

Employees continue to report widespread satisfaction with their jobs (79% in June); however, compared to our April survey, we observed 7% on respondents being unhappy versus 4% in April, showing that there remains dissatisfaction among select groups. One in five employees have plans to look for a job in the near future (21%), versus four in five, who either said no or aren’t sure (79%).

Getting consistent hours at work is a key consideration driving employee satisfaction, but other factors are still on the minds of hourly workers. Team relationships, flexibility, wages and work environment are just some of the other ways owners can win the hearts of Main Street workers.

Source: Homebase Employee Pulse Survey. N = 873 (Feb. ‘23); N = 666 (Apr. ‘23); N = 611 (Jun. ‘23)

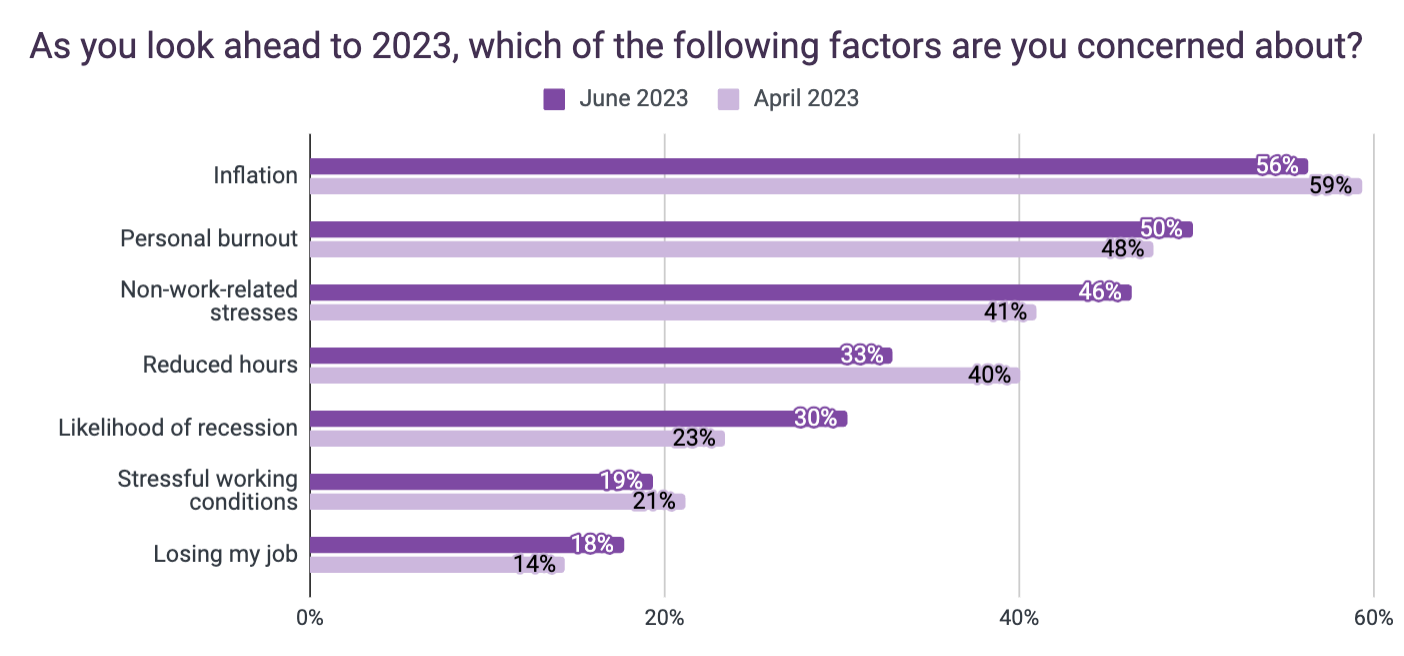

Employees still concerned about inflation but less so on hours

Inflation (56%), burnout (50%) and non-work stresses (46%) remain top concerns for employees. Of note, June showed a steep drop in concerns about reduced hours compared to April (33%, down from 40%), revealing hourly employees are more satisfied with the increased hours on their schedules.

Source: Homebase Employee Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23)

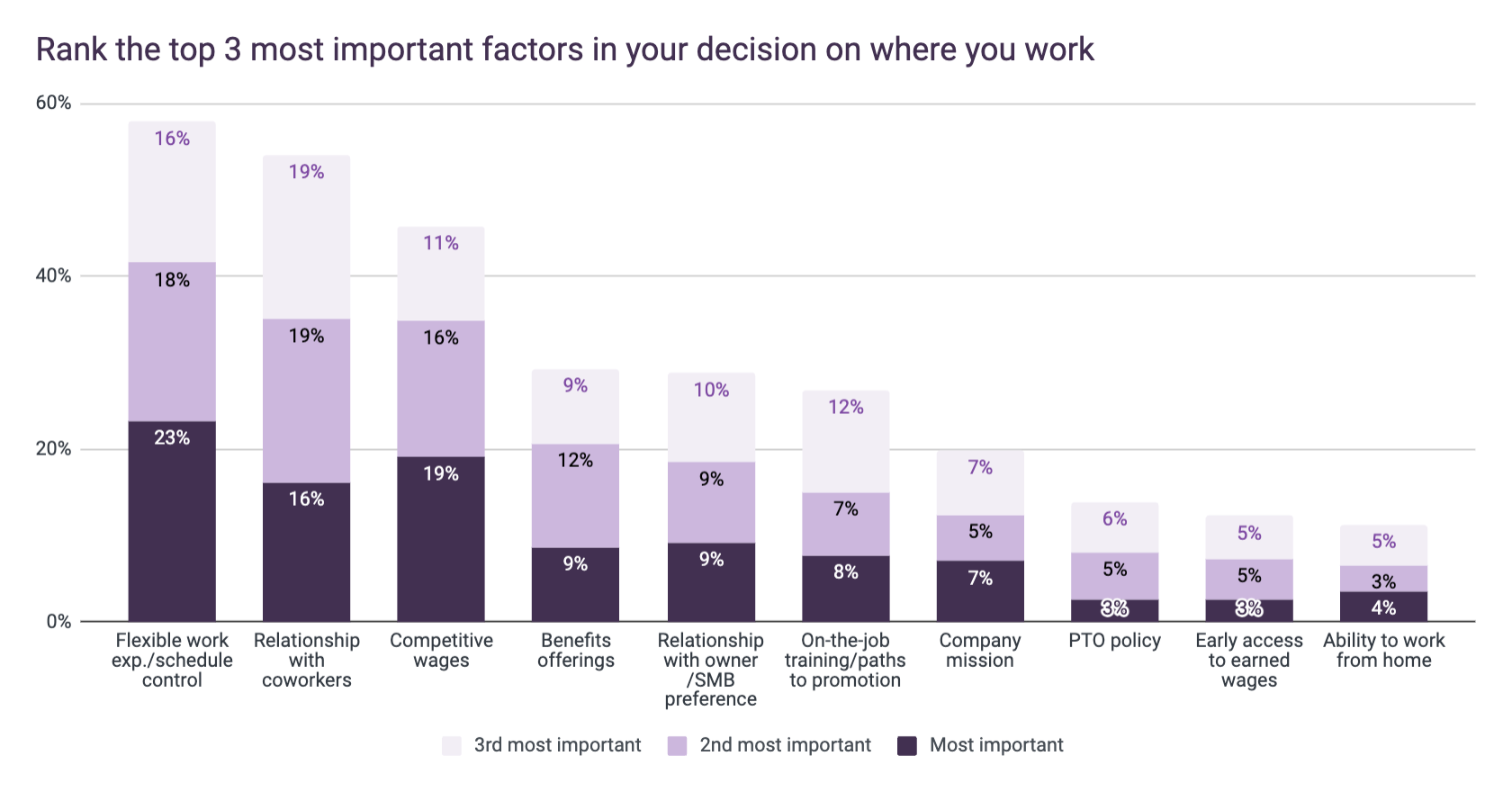

Wages take back seat to other non-pay benefits for workers

It’s not all about the money. While wages remain a compelling factor in workers’ decision on where they work (46% of cited it as a top 3 criteria), June saw non-pay benefits, including schedule control (57%) and coworker relationships (54%), take first and second place.

Source: Homebase Employee Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23)

Link to PDF of: June 2023 Homebase Main Street Health Report If you choose to use this data for research or reporting purposes, please cite Homebase.